Share to Mobile

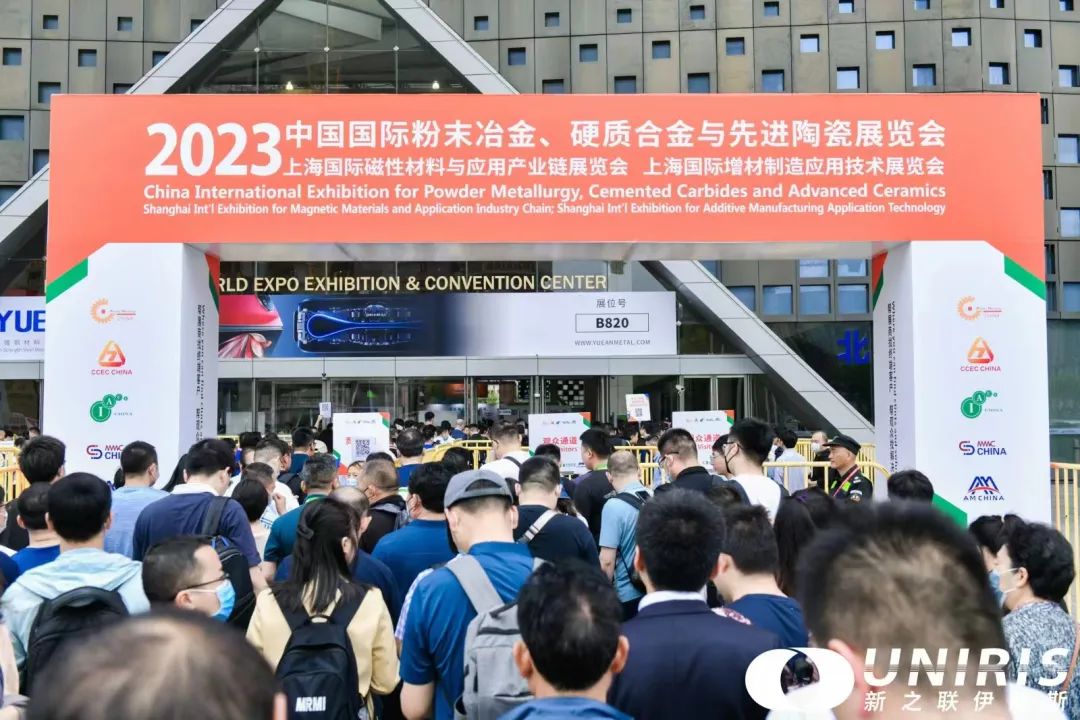

Today, “The 15th China International Exhibition for Advanced Ceramics” organized by Uniris Exhibition Shanghai Co Ltd has grandly opened at Shanghai World Expo Exhibition Center, with excellent exhibitors showcasing comprehensive products and solutions, and industry leaders gathering to share advanced technologies and explore future development. Based on new knowledge, we are in a pursuit of excellence and jointly writing a brand new chapter of industry development.